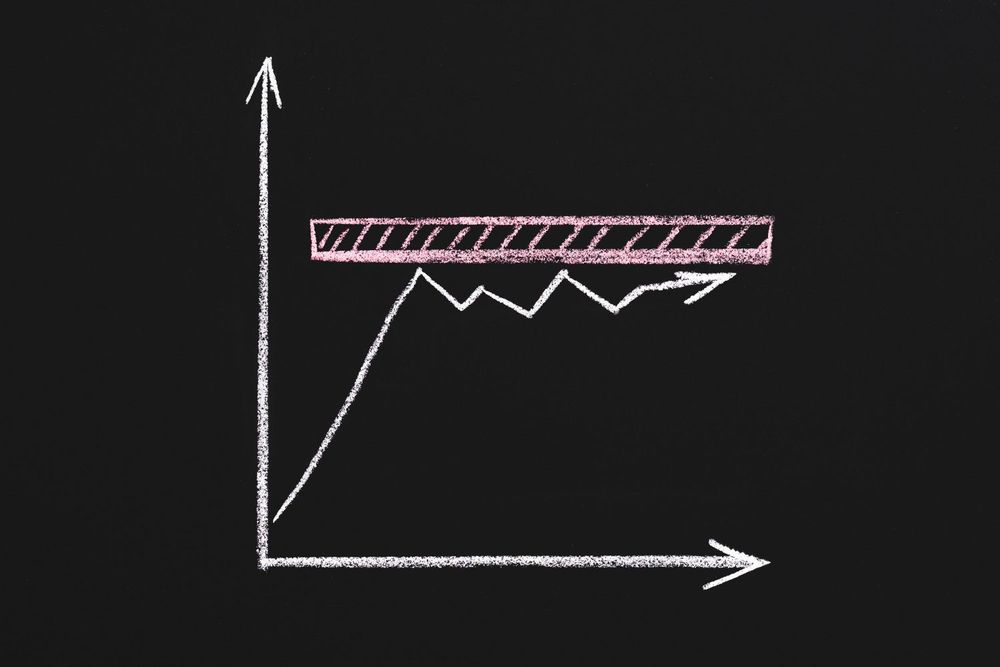

According to a Bloomberg report, Wells Fargo executives anticipate that its $1.95 trillion asset cap may not be lifted until at least the first quarter of 2025. The US Federal Reserve put the cap in place in February 2018 following a string of regulatory issues at the bank.

The cap has stifled the bank's growth while its largest competitors — JPMorgan Chase, Citi, and Bank of America — have seen a swell in deposits. Wells Fargo's executives initially predicted compliance with the Fed's requirements by the end of 2018. However, CEO Charlie Scharf has refrained from speculation since he took the helm in 2019.

"We've been very careful not to put dates out there because we have to do our work and then our regulators have to take a look at it and see if it's done to their satisfaction," Scharf told analysts in July. "We don't want to get ahead of that process, but we continue to move forward."

Executives believe that the first quarter of 2025 is the earliest plausible time for the cap to be removed, considering the timeline of regulatory processes and the presidential election in 2024.

Meanwhile, Wells Fargo continues to execute on the plan it put in place, two years ago, to revamp controls and to regain the trust of its regulators and the public. During this time, the bank's leadership would be wise to attend to the culture that allowed for the conduct central to the many scandals from which it seeks to recover, and to develop proactive governance capabilities rather than focusing solely on tools that detect such misconduct after the fact.

Join The Discussion