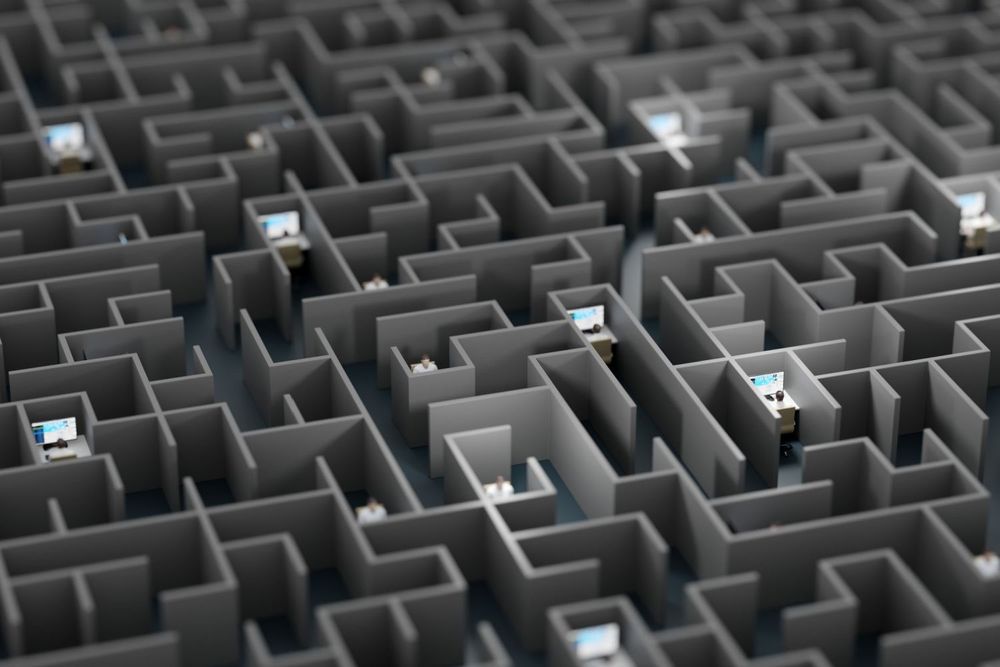

Large banks provide invaluable support to the economy through lending and banking services offered to households and businesses across the country. Twenty years ago, the five largest U.S. banks had roughly $3 trillion in combined total assets. Today, the five largest have more than $12 trillion and are more complex than ever. There are limits to a large organization’s manageability. I have seen enterprises become so big and complex that control failures, risk management breakdowns, and negative surprises occur too frequently—not because of weak management, but because of the sheer size and complexity of the organization. Some identify this as the too-big-to-manage (TBTM) problem, and a growing body of evidence supports this premise. In short, effective management is not infinitely scalable. This axiom underpins the TBTM problem, as well as its solution.

As large banks continue to grow and expand, developing a robust approach to detecting, preventing, and addressing TBTM risks increasingly will become an imperative for banks and bank regulators. Why? Because misidentifying or misdiagnosing problems at a large bank can lead to ineffective actions and solutions, which in turn can prolong the risk of harm to consumers, counterparties, and the financial system. It can also hurt the credibility of financial supervisors, as large banks can take inordinate amounts of time trying to remedy deficiencies, which can and should be addressed quickly.

This content is available to both premium Members and those who register for a free Observer account.

If you are a Member or an Observer of Starling Insights, please sign in below to access this article.

Members enjoy full access to all articles and related content from past editions of the Compendium as well as Starling's special reports. Observers can access a limited number of articles and may purchase articles on an ala carte basis.

You can click the 'Join' button below to become a Member or to register for free as an Observer.

Join The Discussion