Production of our inaugural Compendium, released last year at this time, was prompted by three key observations: (1) that bank regulators had placed an increased emphasis on firm culture as a — and perhaps the — principal driver of employee behavior; (2) that, as such, regulators had come to see firm culture as a primary source of conduct risk, thus deserving of their active supervision; and (3) that nowhere had the full global dialogue around this theme been captured in one place. We sought to address this, distilling emerging consensus views and identifying key points of departure.

Then, as now, we aimed to keep our commentary descriptive rather than normative, and when we did have a particular perspective to offer, we identified that in separate text boxes, clearly labeled as expressing Our View. Yet, on a close read, lurking in the background throughout that inaugural report was a distinct bias, seen reflected at the apex of the word-cloud featured above: our belief that trust is of central importance to the discussion of culture and conduct risk issues.

In this, our 2nd annual Compendium, that bias is brought to the fore at the outset in Greg Medcraft’s preamble: “Trust — or the lack of it,” he writes, “has become one of the defining social, political and economic features of our time.” Evidence that he is correct in this assertion abounds.

It is alarmingly clear that, today, mis-trust represents what those in defense policy circles might refer to as a “strategic vulnerability” — one that is being exploited specifically by those working to disrupt the full functioning of the world’s democracies. As one study details, these actors are highly purposeful in their efforts to “undermine citizens’ trust in government, exploit societal fractures, create distrust in the information environment, blur the lines between reality and fiction, undermine trust among communities, and erode confidence in the democratic process.”1

This moves us well beyond business-as usual discussions that prioritize shareholder value calculus: improving trust in our financial system and its constituent elements is, rightly, a policy priority.

If mistrust is a strategic vulnerability, then restoring trust must be regarded as a strategic priority. And, given the importance of the financial services sector to any capitalist democracy, that trust should be seen as a strategic priority among banks and their supervisors is plainly self-evident.

This view was heard throughout 2018. In its Annual Report, the IMF argued “global economic momentum is under pressure from a slow erosion/weakening of trust in institutions—and trust, of course, is the lifeblood of any economy.”2 The World Bank’s annual Spring Meetings featured a discussion of risks to the global financial system represented by what participants termed the “distrust trap.”3 The same theme was echoed repeatedly at Davos.4 Our academic advisor, Stanford Professor Karen Cook, expands on this topic in the Our View readers will find here.

Concern for trust in the financial system was front and center in Australia over the last year, as we detail herein. (see page 27) In a series of public hearings, the specially-convened Royal Commission into Misconduct in the Banking, Superannuation and Financial Services Industry laid bare pervasive examples of gross misconduct among all of the country’s principal financial firms. With an election looming in May 2019, mistrust in the banking sector has become a distinct political flash-point.5.

But trust is not merely a priority for policy-makers, central bankers, and academic inquirers. As Gallup reports, businesses worldwide are suffering from “a crisis of trust.”6 They tie this directly to questions about firm culture, asking whether a culturally-driven “bounded ethicality” may lead employees to behave unethically without even being fully conscious of their behavior as such.

Gallup lays responsibility here with managers who, it asserts, must act individually and collectively to ensure “that performance targets and incentive systems do not lead employees to (consciously or unconsciously) make unethical decisions, that employees are fully aware of ethical issues relevant to their work and that their team members feel free to express any ethical concerns.”

If mistrust is a strategic vulnerability, then restoring trust must be regarded as a strategic priority.

The UK’s Financial Conduct Authority has long championed the view that firm culture is a matter of significance for bank supervisors. Latterly, echoing Gallup, the FCA has emphasized the importance of trust dynamics among employees as setting the pre-conditions for a culture within which they will feel free to “speak out” — or not — when ethical concerns arise, or misconduct is witnessed.7

The FCA now contends that perceptions of “psychological safety” among employees is a matter for its supervisory attention, seizing upon research that suggests, “if you want employees to speak up, the work environment and the team’s social norms matter.”8 We see this new emphasis in recent news of the regulator launching inquiries into “working culture” at specific firms.9 Nor are startup “challenger banks” free from such regulatory scrutiny of their own work cultures.10

This scrutiny is warranted. Conduct is contagious, Starling advisor and Yale Professor Nicholas Christakis argues in the Our View found here. Research repeatedly demonstrates that individual behavior is directly influenced by the witnessed (mis-)behavior of peers and that, within firms, employees are demonstrably liable to engage in “conditional dishonesty.”11

As former NY Federal Reserve Bank president Bill Dudley has repeatedly reminded, “context drives conduct.”12 And, as Christakis observes, what is “common is moral.”13 Such findings contribute to a broader recognition that behavioral science has much to offer in the supervisory context.

The application of behavioral science to conduct risk supervision was significantly advanced by the early work of De Nederlandsche Bank (DNB), which aimed to develop “psychological methodologies and techniques” that would aid the Dutch bank regulator in its supervisory efforts. In its influential, Supervision of Behaviour and Culture: Foundations, Practice & Future Developments, principal author (and Starling advisor) Mirea Raaijmakers argues that, to identify and mitigate culture and conduct risks effectively and consistently:

…it is crucial to develop a common conceptual model and a common supervisory language on behaviour and culture. By defining culture— both its visible and invisible aspects — in a concrete manner, we can apply this concept to supervision.14

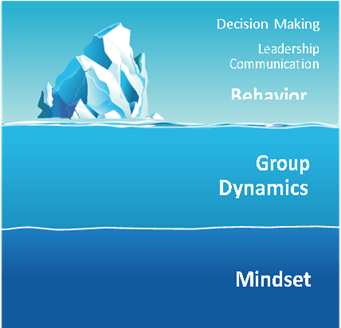

The DNB uses an iceberg metaphor to depict how culture operates, with observable behavior being shaped by underlying “group dynamics” — defined as “patterns of interaction,” within a group or between groups, that work to affect overall group effectiveness. In this context, it attends specifically to whether such patterns are marked by mutual trust, or distrust.

Still deeper below the surface, the DNB calls attention to the “mindset” inculcated among employees — “mental models” and “assumptions about reality” that implicitly inform individual and group decision- making and behavior.

Referencing the work of organizational psychologist, Edgar Schein, the DNB contends that these invisible group dynamics and mindsets which, together, form “a pattern of shared basic assumptions” about what behavior is expected in a given organizational context.15 For the DNB, it is the supervisor’s task to surface these underlying drivers of behavior. The DNB achieves this through an intensive examination process that involves six elements: desk research, firm self-assessments, staff surveys, interviews, observations during meetings attended by the supervisor, and other observations made during time spent within the organization.16

The past year has seen regulators in other jurisdictions adopt the DNB’s pioneering approach. For instance, the Central Bank of Ireland initiated “Culture and Behavior Reviews” of the country’s main retail banks, collaborating closely with the DNB’s behavioral science team in this process.17

And the Monetary Authority of Singapore (MAS) has established a behavioral sciences unit to run “culture research and empirical studies,” with a view to enhancing its policy design work and the efficacy of its supervisory interventions through applied behavioral science techniques.18 Notably, this initiative was pointed to specifically when MAS was named Central Bank of the Year in 2018.19

In a speech made at the San Francisco Federal Reserve Bank last summer, Ravi Menon, Managing Director of MAS, spoke of the “enhanced supervision” that he anticipates will characterize the next decade. He envisions regulators collaborating to establish common frameworks for culture and conduct supervision, drawing specifically on the tools of behavioral psychology.20

But bank regulators are not alone in attending to such “soft-stuff.”21 Shared interest in bottom line outcomes has prompted the emergence of what might be termed an “ecosystem approach” to the challenge of improving governance and supervision of culture and conduct risk, and has prompted a global dialogue that includes regulators, standard setting bodies, investors, industry associations, and firms. As the Group of Thirty (G30) Working Group on Culture and Conduct argued in a 2018 report, attention to culture “needs to become a permanent, fundamental, and integral part of how business is invariably done rather than being addressed through a series of ad-hoc initiatives.”22

Over the course of 2018, this culture and conduct dialogue appears to have melded into a previous dialogue regarding corporate governance reform, and we now see increasing attention to culture from the world’s largest investors.23 For instance, State Street Global Advisors recently noted that it will focus on corporate culture “as one of the many, growing intangible value drivers that affect a company’s ability to execute its long-term strategy,” echoing Greg Medcraft’s opening remarks.24

In his January 2018 annual letter to CEOs of the world’s largest companies, Blackrock’s Larry Fink set the current tone when he wrote, “To prosper over time, every company must not only deliver financial performance, but also show how it makes a positive contribution to society.” Those failing to do so, he warned, “will ultimately lose the license to operate from key stakeholders.”25

Fink doubled down on this argument in his 2019 letter. Observing that the world is now witnessing the largest wealth transfer in history — $24 trillion from baby boomers to millennials — he notes that the newer generation will have different investment priorities than the older, and will place a far greater emphasis on environmental, social, and governance issues (ESG) that will be “increasingly material to corporate valuations.”26 Firm culture is a key governance issue in this context.

This perspective is reflected in the 2018 UK Corporate Governance Code, which called on boards “to create a culture which aligns company values with strategy and to assess how they preserve value over the long-term.”27 Similarly, in Singapore, MAS recently announced the creation of a Corporate Governance Advisory Committee. Led by private firms, this standing body has been constituted to promote a “levelling up” of governance standards and practices in order to “uphold Singapore’s reputation as a trusted international financial centre.”28 Here again, concern for trust in the financial sector is seen as linked with an ecosystem approach to governance reform and an attendant focus on culture as a driver of firm value. This now appears to be an established agenda, and we anticipate hearing more along these lines in the year ahead.

The past year also saw increasing collaboration among regulators in the domain of “RegTech.” In a “Consultation Document” issued by the FCA in August 2018, a group of a dozen regulators across the globe announced their intent to establish a Global Financial Innovation Network.29 (“GFIN”) When formally launched, in January 2019, the GFIN’s membership had grown to include twenty-nine regulators and other interested organizations, with three specific aims:

In February, the GFIN solicited applications from firms interested in joining an initial cohort for cross-border pilot testing. Participants are due to be announced shortly and pilot testing is expected to begin in the second quarter this year.30 “These technologies have the potential to reshape the relationship between regulators and market participants,” concludes a recent European Securities and Markets Authority report.31

Confidence in traditional economic metrics — and economists — has plummeted in the decade since the financial crisis, renowned economist Mohammed A. El-Erian argued recently. By way of explanation, he points to the profession’s predilection for “simplistic theoretical assumptions,” an over-reliance on mathematical techniques “that prize elegance over real-world applicability,” and a “routine failure” to draw on insights from behavioral science.32

With culture now regarded as a valuable if intangible asset, there is a need for better measures of such intangibles, and an ability to capture the “off balance sheet costs” that may be present when they are impaired.33 That is, we need a better means of identifying and measuring the “unknown unknowns.”34

This is now a supervisory priority for, as the Financial Stability Board has observed, “the culture of an institution can defeat its formal governance.”35

In the absence of established, reliable and quantitative culture and conduct risk metrics we are left to rely upon proxy measures. And efforts to develop better such proxies has brought the dialogue concerning culture and conduct into a direct confluence with the prominent current discourse regarding diversity and gender (dis-)parity.

The FCA, for instance, will now regard poor “Diversity & Inclusion” metrics as a proxy indicator of broader culture problems and the increased conduct risk that such problems represent.Its interest in diversity “is not merely a matter of social justice,” FCA Executive Director Chris Woolard stated recently, “but a core part of how we assess culture in a firm.”36

“Firms that promote gender diversity also significantly lower their conduct risk,” Megan Butler, an FCA supervisor, told a Women in Finance Summit in London. “And this is where the FCA’s interest comes in. Firms with monocultures suffer 24% more governance-related issues than their peers.”37

The FCA is not alone. In a recent speech, Derville Rowland, the Central Bank of Ireland’s head of conduct supervision, made plain her view that, “a lack of diversity at senior levels is a leading indicator of behavior and culture risks in financial institutions.” Supporting this claim, she pointed to research that suggests “management teams with an equal gender mix perform better than male-dominated and female- dominated teams in terms of sales, profits and earnings per share.”38

Research does seem to indicate that more diverse teams produce superior performance outcomes, but the argument as to the ultimate source of those outcomes remains murky.

Diversity of thought is often pointed to as key. But promoting a diverse “marketplace of ideas” helps only to guarantee that a wider range of alternatives will be put forward, not that superiorideas will be selected. Nor is it immediately clear why a wider range of ideas, considered among a more diverse group, should be expected to reduce conduct risk. Something essential is missing.

And, here again, we are pointed to behavioral science. Authors of a recent study published in the Harvard Business Review find that: “Diversity doesn’t work without psychological safety,” and that “people only contributed unique ideas to the group when they felt comfortable enough to speak up and present a contrarian view.”39

That is, people must have cause to trust that the group will support them, even — and especially — when offering a dissenting view.

If this is correct, then findings reported by the UK’s Banking Standards Board in 2018 are worrying. Its 2017/2018 annual survey established that a significant number of UK bankers are loath to speak up when misconduct is witnessed. Many indicated an expectation that speaking up will result in negative consequences, citing “cultures of fear and blame.” Equally, many felt that, even were they to speak out, they had cause for little faith that their organization would take corrective action.40

Such findings illustrate the impact of the group dynamics and mindset to which the DNB calls our attention and reflect how “shared basic assumptions” lead to concrete behavioral outcomes. It is this that we must be able to test for if we are to devise improved culture and conduct risk metrics.

As Thomson Reuters reported in 2018, following its fifth annual survey on the topic, canvassing over 600 global financial institutions, “measuring culture and conduct risk remains a challenge for firms, with a combination of compliance monitoring results, staff opinion surveys, complaints analysis and internal audit results all being widely used as metrics.”41

However well-intentioned, this approach has not generated the desired outcome and, as this 2019 Compendium outlines, regulators no longer view such methods as sufficient. Over the course of the last year, we have heard distinct calls for improved metrics.

If they are to be reliable, these metrics must be quantitative and data-driven in nature, and they must be informed by a deep appreciation for the ways in which interpersonal trust dynamics drive invisible behavioral norms, observed behavioral trends, consequent company performance and, thus, broad stakeholder outcomes.

“As we continue to see the impact of technology and big data in other parts of financial services, one interesting question is how innovation and enhanced technology will support the measurement and management of culture,” the NY Fed’s Kevin Stiroh has noted.42“For example, we might see firms routinely leverage broader data to make stronger predictions about potential misconduct risk”.

Newly devised “computational social science” techniques offer much here. Such tools permit for the measurement of trust dynamics within an organization by sifting signals from company data and, in so doing, producing heretofore unavailable insights into the underlying drivers of conduct and into how those drivers may predictably permeate a firm.43

By distilling hitherto unavailable insights from standard company data sets, RegTech firms making use of such computational social science methodologies can better identify and help to mitigate risks that are not sufficiently well captured by current standard metrics and governance processes.

By 2020, KPMG anticipates that spending on RegTech will come to make up more than a third of all regulatory spending, as the firms and regulators now trialing these tools begin to view culture and conduct risk management as data and prediction problems addressable through technology.44

Join The Discussion